The Saudi government is reviving plans for a follow-on offering of Aramco shares this year

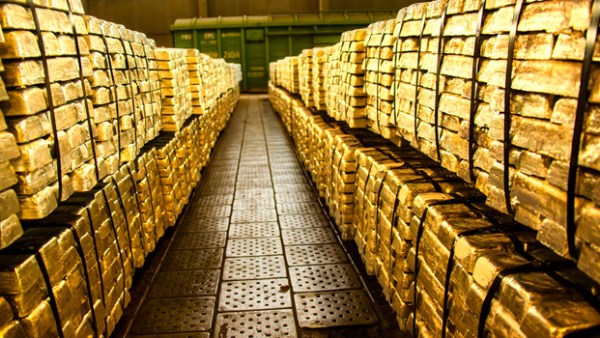

Aramco Raises Payout to $31 Billion in Boost for Saudi Budget

Aramco raised its dividend despite a retreat in energy prices and lower production، a boost for Saudi Arabia as it faces a widening budget deficit.

The total payout of about $31 billion، which includes a special component، for the fourth quarter rose even as lower oil output pushed net income down 25% year-on-year. Aramco guided that the total distribution to investors and Saudi Arabia’s government this year will be higher than in 2023.

The world’s biggest crude oil exporter provides much of the Saudi government’s income via generous dividends. The payout is becoming ever more vital as Crown Prince Mohammed bin Salman pursues expensive projects such as the futuristic project of Neom، the purchase of high-profile footballers and stakes in sporting leagues، while looking to diversify the economy from oil.

The higher dividend also comes as The Saudi government is reviving plans for a follow-on offering of Aramco shares this year. Global investors had balked at the kingdom’s valuation expectations and the kingdom’s low yield compared with industry peers during the firm’s 2019 IPO.

Potential investors will keep an eye on the state’s budget shortfall. The Saudi government is predicting a deficit every year until 2026، pushing it to delay past 2030 some of the projects that it launched as part of its economic transformation plan. It also ordered Aramco last month to halt the expansion of its production capacity، helping free up spending for other areas.

The suspension is likely to reduce Aramco’s capital investments by about $40 billion between this year and 2028، the company said in a statement. Capital expenditure rose about 28% to just short of $50 billion last year، and is expected to be $48 billion to $58 billion in 2024.

‘Increased Flexibility’

The government’s directive “provides increased flexibility، as well as an opportunity to focus on increasing gas production and growing our liquids-to-chemicals business،” Chief Executive Officer Amin Nasser said in the statement.

Riyadh needs crude above $90 a barrel this year to fund spending plans، according to Fitch Ratings. Brent crude in London closed near $82 last week. Saudi Arabia’s oil export revenue sank to $248 billion last year، a decrease of nearly $80 billion that offered a reminder of its dependence on high energy prices.

Aramco paid a total dividend of almost $98 billion in 2023. If it maintains the base payout at the fourth quarter’s level of $20.3 billion، and with a promise to distribute $43.1 billion in performance-linked dividends in 2024، total payments for this year will be $124.3 billion، a 66% increase since 2021.

The company has been restricting oil output as part of efforts by the Organization of Petroleum Exporting Countries and its allies to revive the market and prevent a supply surplus. Aramco’s production of liquid fuels dropped to 10.7 million barrels a day last year from 11.5 million a day in 2022.

-1120252475029447.jpg)