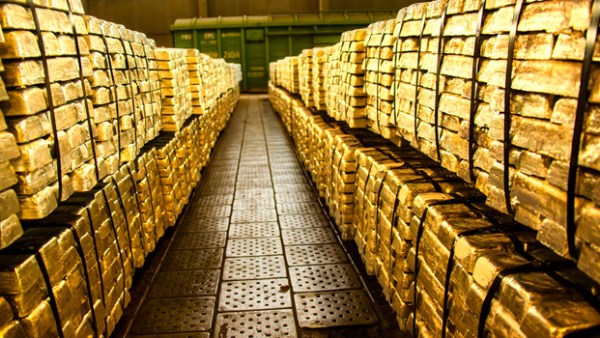

The fund currently has a position of around $100 million in U.S. Treasuries

Danish pension fund to sell $100 million in Treasuries, citing 'poor' U.S. government finances

Danish pension operator AkademikerPension said it was exiting U.S. Treasuries because of finance concerns as the country spars with President Donald Trump over his calls to takeover Greenland.

Anders Schelde, AkademikerPension's investing chief, said the decision was driven by what it sees as "poor [U.S.] government finances" amid America's debt crisis. But it also comes as tensions escalate between the U.S. and Denmark after Trump's latest threats to tariff European countries if Greenland wasn't sold to America.

"It is not directly related to the ongoing rift between the [U.S.] and Europe, but of course that didn't make it more difficult to take the decision," Schelde said in a statement to CNBC.

The fund currently has a position of around $100 million in U.S. Treasuries, an AkademikerPension spokesperson confirmed to CNBC. It plans to have exited that holding by the end of the month.

Schelde chiefly cited the ballooning debt bill facing the U.S. after decades of government overspending. The U.S. recorded a budget shortfall of $1.78 trillion last year, down just over 2% from 2024's fiscal year as Trump's broad and steep tariffs took effect.

Moody's Ratings cut the United States' sovereign credit rating down to Aa1 from Aaa last year, citing the budget deficit and high borrowing costs associated with rolling over debt at lofty interest rates.

The U.S.' finances made "us think that we need to make an effort to find an alternative way of conducting our liquidity and risk management," Schelde said. "Now we have found such a way and we executing on that."

But the move also comes as Denmark grows increasingly hostile toward the U.S. as Trump has ratcheted up his calls for Greenland, an arctic island operated by the European country. Trump said over the weekend that he would institute tariffs on several European nations beginning Feb. 1 if the U.S. did not take control of Greenland and that those levies could rise to 25% on June 1.

European leaders have reportedly considered using counter-tariffs and other punitive economic measures as a result. Some investors have worried that European countries could dump their U.S. asset holdings in response to Trump's new tariffs.

-1120252475029447.jpg)