IIF: Egypt historic Ras El-Hekma deal brings valuable cash inflows to achieve macroeconomic stability

Insitute of International Finance، IIF، stated that Egypt historic Ras El Hekma deal will bring in $35bn of immediate financing within the next couple of months The cash windfall will help cover Egypt’s external financing needs over the next few years and، combined with a potential expanded IMF program، can boost gross reserves to over $50bn (8 months of imports)، while the scale and speed of investment surprised on the upside، with markets reacting favorably to the news.

Egypt historic Ras El Hekma deal should be accompanied by the implementation of reforms

Insitute of International Finance، IIF، confimed that Egypt historic Ras El-Hekma deal should be accompanied by the implementation of reforms to achieve macroeconomic stability with IMF program agreement in the coming weeks، which will include a modest devaluation and reforms.

Insitute of International Finance، IIF، indicated that the cash windfall from Ras El-Hekma deal will help cover Egypt external financing needs over the next few years as the scale and speed of investment surprised on the upside، with markets reacting favorably to the news and these important steps can help Egypt achieve macroeconomic stability.

Ras El-Hekma deal will reduce net foreign liabilities at the Central Bank

Insitute of International Finance، IIF، revealed that Egypt historic Ras El-Hekma deal will reduce net foreign liabilities at the Central Bank، CB، by around 3% of GDP with $11bn of UAE deposits being written off، and total external debt will fall from its FY22/23 peak، with the debt-to-GDP ratio remaining manageable.

Insitute of International Finance، IIF، assured that Egypt historic Ras El-Hekma deal accelerated the new، $8bn IMF program، with a strong devaluation of the pound which exceeded expectations thanks to the historic deal that brings valuable cash windfall.

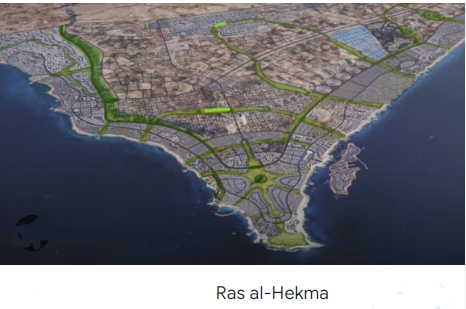

Ras El-Hekma deal is the largest inflow of FDI in the history of Egypt

Prime Minister Mostafa Madbouly announced a massive $35bn (~8% of GDP) deal with ADQ، an Abu-Dhabi-based sovereign wealth fund، marking the largest inflow of FDI in the history of Egypt as the deal gives ADQ development rights for the new Ras El-Hekma city، a 170 million square meter project west of Alexandria، in return، and based on preliminary information، Egypt will receive $24bn in direct liquidity and $11bn in UAE deposits that are to be written off and converted to Egyptian Pounds for investment in other projects that support economic growth and development.

Prime Minister Mostafa Madbouly also announced that $15bn should be received by the end of February، while the remaining $20bn would arrive within two months، while ADQ noted that it expects more than $150bn of total FDI during the lifespan of the project، according to Insitute of International Finance، IIF.

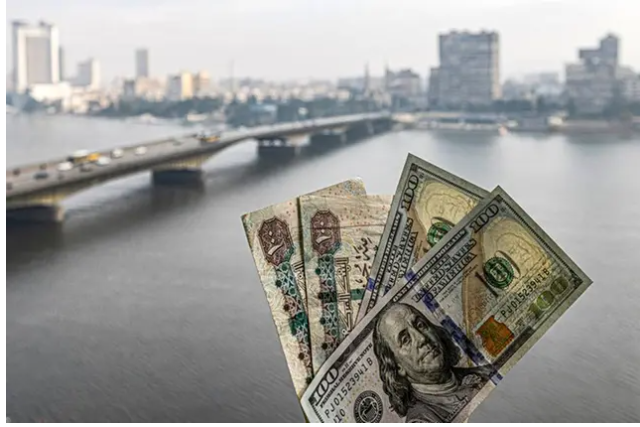

The parallel exchange rate appreciated markedly by Ras El-Hekma deal

Insitute of International Finance، IIF، declared that the parallel exchange rate، which had been trading at around 70 EGP/US$ before the announcement of Ras El-Hekma deal، appreciated markedly and is now trading in the range of 45-50 EGP/US$، while non-deliverable forwards also fell on the news، indicating market expectation for a smaller devaluation and dollar bonds continued their upward momentum، with longer-dated bonds now trading above the 70 % distressed bond threshold.

Garbis Iradian، Chief Economist، MENA region، at Insitute of International Finance، IIF، sees that the positive market reaction is well warranted، as the large windfall of hard currency will help ease the financing pressures Egypt was facing.

IIF forecasted total financing needs at around $15bn

Garbis Iradian، Chief Economist، MENA region، at Insitute of International Finance، IIF، forecasted total financing needs at around $15bn، cumulative from FY23/24-FY25/26 and suspected that most of this gap was going to be filled by a new، expanded، IMF program and by proceeds from privatization.

However، the $24bn in FX liquidity that the UAE will transfer to Egypt will help cover any remaining financing needs in the foreseeable future though Garbis Iradian، Chief Economist، MENA region، at Insitute of International Finance، IIF، expected part of this cash to be used for other means، such as clearing the import backlog or for moderating the pressure in the parallel exchange rate market.

IMF program ($8bn) will further bolster Egypt’s reserve assets

The additional inflows from the IMF program ($8bn) will further bolster Egypt’s reserve assets، helping coversome of the large IMF repurchases due in the next 2 fiscal years while also mobilizing other multilateral aid، while the combined inflows from the IMF and the Ras El-Hekma project can lead to gross international reserves increasing to over $50bn by the end of the current fiscal year، said Ivan Burgara، Economist ،at MENA region، at Insitute of International Finance، IIF.

Ivan Burgara، Economist ،at MENA region، at Insitute of International Finance، IIF، explained that the announced cash injection will reduce net foreign liabilities at the Central Bank and help Egypt’s debt-to-GDP ratioas the $11bn in UAE deposits ($5.7bn MT/LT and $5bn ST) that is being converted to Egyptian pounds will help reduce net foreign liabilities at the Central Bank by around 3% of GDP، leading the CB to post a positive net foreign asset position in FY23/24.

The elimination of the UAE deposits will reduce total external debt

In addition، the elimination of the UAE deposits will reduce total external debt and in dollar terms، Ivan Burgara، Economist ،at MENA region، at Insitute of International Finance، IIF، forecast total external debt to fall from a peak of $165bn in FY22/23 to $157bn in FY23/24، as the reduction of $11bn is slightly offset by non-resident debt inflows and other official lending.

As a percent of GDP، external debt will remain manageable at 45% of GDP in FY23/24، up from 42% in FY22/23، however، the increase in the debt-to-GDP ratio is caused by a fall in the denominator، as nominal GDP in dollar terms is expected to fall due to a forecasted devaluation affecting the weighted average exchange rate، according to Ivan Burgara، Economist ،at MENA region، at Insitute of International Finance، IIF.

Central Bank to allow the market to determine the exchange rate

Official statements on March 6th brough surprises that exceeded Economists ،at MENA region، Insitute of International Finance، IIF، expectations as the Central Bank announced that it would allow the market to determine the exchange rate، in an attempt to unify its exchange rate and the Pound depreciated close to 40% and is currently trading at 50 EGP/US$، slightly above the parallel rate of 51، and to support this، the Central Bank hiked its policy rate by 600bps which is much larger than market expectations of 2-3%، while a few hours later، the IMF announced a staff-level agreement on the first and second reviews of the Extended Fund Facility (EFF) program، which would be expanded from $3bn to $8bn dollars.

IMF program will set up a reform agenda combined with FDI inflows

Insitute of International Finance، IIF، concluded that these

developments very positive as the IMF program will set up a reform agenda that، combined with FDI inflows from the Ras El-Hekma project، can put Egypt on a sustainable path، while the floating of the pound should serve as a catalyst for privatization and further FDI inflows.

However The large influx of hard currency is a valuable short-term fix but Egypt must remain on the reform path for long-term sustainability، so that Egypt becomes able to take full advantage of this opportunity، while continuing with the IMF-backed structural re-forms focused on macroeconomic stability، restoring reserve buffers، and shifting towards a market determined exchange rate، as well as enabling private-sector led growth.

- Egypt

- central bank

- IIF

- GDP

- debt

- Insitute of International Finance

- Ras El Hekma

- Ras El Hekma deal

- Egypt historic Ras El Hekma deal

- valuable cash inflows

- cash inflows

- macroeconomic stability

- cash windfall

- IMF program

- external financing needs

- net foreign liabilities

- largest inflow

- parallel exchange rate

- gross reserves

- Egypt s reserve assets

- total external debt

- FDI inflows