The company maintained its fiscal 2025 sales guidance of $58 billion to $61 billion.

Eli Lilly sales soar 45% on weight loss drug demand, but drugmaker cuts profit outlook after cancer treatment deal

Eli Lilly on Thursday reported first-quarter revenue and earnings that topped estimates as demand for its weight loss and diabetes drugs soared, but lowered its full-year profit guidance due to charges related to a recent cancer treatment deal.

The pharmaceutical giant now expects its adjusted fiscal 2025 earnings to come in between $20.78 and $22.28 per share, down from previous guidance of $22.50 to $24 per share. Eli Lilly said the revision reflects a $1.57 billion deal charge recorded in the first quarter, which is primarily related to its acquisition of a certain oral cancer drug from Scorpion Therapeutics.

The company maintained its fiscal 2025 sales guidance of $58 billion to $61 billion. Eli Lilly said the guidance reflects President Donald Trump’s existing tariffs as of May 1, but does not include his planned levies on pharmaceuticals imported into the U.S.

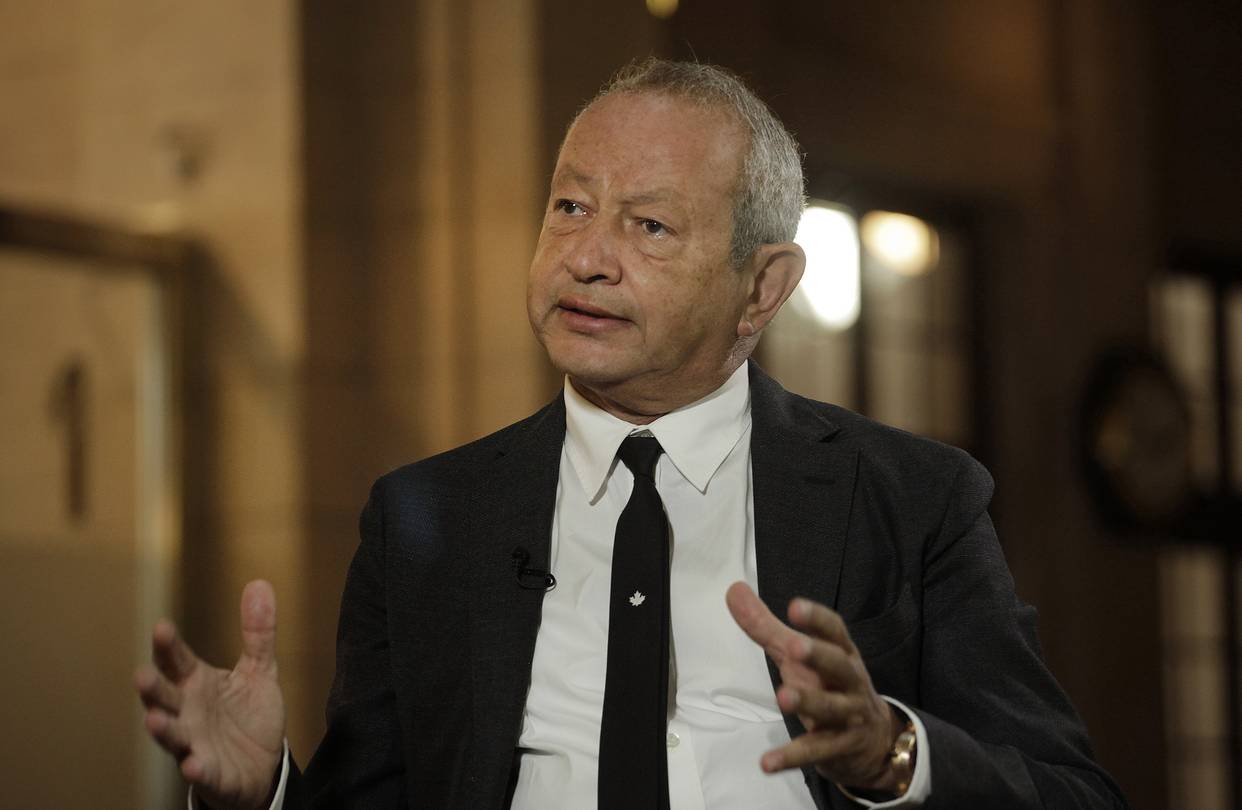

In an interview with CNBC, Eli Lilly CEO Dave Ricks said the company and other drugmakers are already announcing investments in U.S. manufacturing, which is one of the Trump administration’s stated goals of the tariffs.

“I think that actually the threat of tariffs is already bringing back critical supply chains into important industries, chips and pharma,” Ricks said. “So do we need to enact [tariffs?] I’m not so sure.”

He added that Eli Lilly wants to see permanently lower tax rates in the U.S., particularly 15% for domestic production. Ricks said lower taxes drove many drugmakers to manufacture in “low-tax islands like Ireland Singapore and in Switzerland, and that can come back if there’s an economic incentive.”

Eli Lilly’s blockbuster diabetes treatment Mounjaro topped expectations for the first quarter, raking in $3.84 billion in revenue. That’s up a whopping 113% from the same period a year ago.

-1120252475029447.jpg)