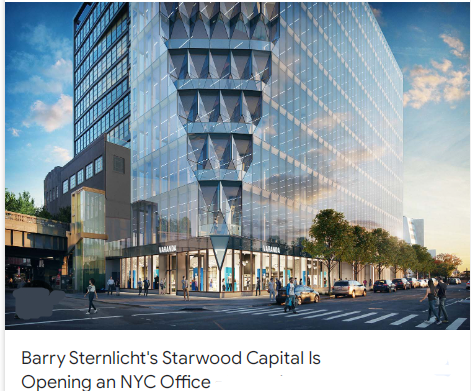

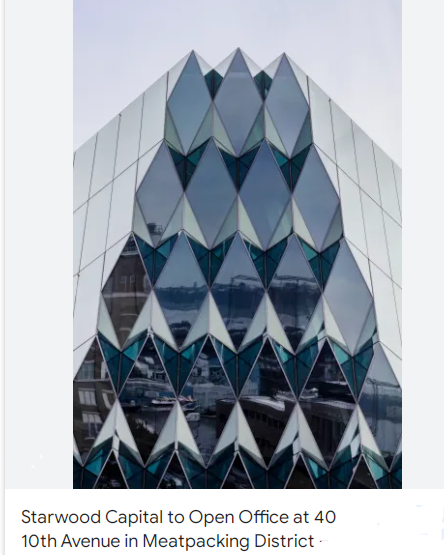

American Billionaire Barry Sternlicht warns office real estate lost $1.2 Trillion since2022

American Billionaire Barry Sternlicht، the co-founder، Chairman، and CEO of Starwood Capital Group، an investment fund with over $120 billion in assets under management، believes that offices، once a $3 trillion asset class، now become probably worth $1.8 trillion، that is $1.2 trillion of losses spread somewhere، and nobody knows exactly where it all is، while property owners have struggled to refinance loans as building values declined as the Federal Reserve increased interest rates rapidly over the past two years.

American Billionaire Barry Sternlicht sees more than $1 trillion of losses for office real estate، calling the properties one asset class that never recovered from the loans of the increased interest rates.

Office market has an existential crisis right now

American Billionaire Barry Sternlicht revealed that the office market has an existential crisis right now،” which is largely a US phenomenon because workers haven’t gone back to their desks، calling the office real estate the one asset class that never recovered from the pandemic of covid19.

American Billionaire Barry Sternlicht stated Tuesday at the iConnections Global Alts conference in Miami Beach، that the FED's relentless raising of interest rates has caused untold damage to markets and economies equal to about $36 Trillion Lost! so he begged the FED last year to stop raising the interest rates or the real estate market would collapse.

Regional banks disappeared from the market

American Billionaire Barry Sternlicht affirmed that regional banks have previously been a source of funds for real estate owners، but they have disappeared from the market as property owners have struggled to refinance loans as building values declined and the interest rates increased rapidly since 2022 till the end of last year.

Property owners and especially those haing office real estate، are in the business of getting loans،while the banks don’t show up، they’re not even playing and the alternatives are the debt funds، which are having a field day، according to American Billionaire Barry Sternlicht.

Barry Sternlicht expects the first rate cut to come in June

American Billionaire Barry Sternlicht expects the first rate cut to come in June after the Fed’s policies have left a serious mess in capital markets and real estate and anything that’s yield related، however، the world’s most successful and respected real estate investors are sounding alarm bells of the hurricane brewing in the real estate market.

American Billionaire Barry Sternlicht is considered one of the largest real estate firms in the world and Sternlicht’s position as CEO gives him an inside look into what’s happening in the real estate market، that is why he talked about a quote “category five” hurricane that’s months away from hitting the real estate market.

The relationship between real estate values and interest rates

To truly understand what is going on in the real estate market، you first need to understand the relationship between real estate values and interest rates: real estate is an asset that has what is referred to as a fixed income stream and a fixed income stream is a relatively predictable amount of cash year in and year out.

If you are an owner of an office building and your tenant has a 10 year lease، you know what you should be getting paid in rent over the next 10 years and these locked in cash flows are the fixed income stream real estate produces but any asset with a fixed income stream decreases in value as interest rates rise، rxplained American Billionaire Barry Sternlicht.

Real estate is a commodity dependent on the cash it generates

Real estate is what economists refer to as a commodity and the price of any commodity is dependent on the supply and demand dynamics at that given time، while it is known from earlier that the value of the building is dependent on the cash it generates، however، what determines what rent you as the owner can charge for each of those units is the supply and demand of apartments within that particular real estate market، he added.

Over the past few years، the economy has been extremely strong as unemployment was low and government stimulus programs were high as well as the home prices skyrocketed، forcing many would be home buyers to stay renters، American Billionaire Barry Sternlicht said، noting that for owners of the apartment building، so-called "strong fundamentals" is when demand outstrips supply.

He concluded that these factors caused demand for apartment and office units to increase، pushing the demand line here out to the right so the supply and demand line now cross at a much higher price and as the higher rents increased the cash apartment buildings generated، making them even more valuable.

-1120252475029447.jpg)