الأحد، 01 مارس 2026

10:06 ص

عاجل

OpenAI تجمع 110 مليارات دولار بقيادة أمازون وسوفت بنك وإنفيديا

«الصناعة» تطرح 1272 قطعة أرض صناعية كاملة المرافق في 23 محافظة

ترامب ميديا تدرس إدراج منصة "تروث سوشيال" في البورصة

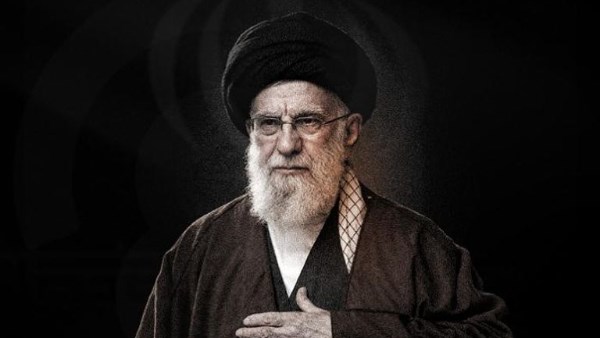

مقتل علي شمخاني كبير مستشاري خامنئي ومحمد باكبور قائد الحرس الثوري

هاني جنينة يتوقع انخفاض أسعار البترول إلى أقل من 60 دولارًا للبرميل

الحرس الثوري الإيراني يتوعد بأعنف هجمات ضد إسرائيل والقواعد الأمريكية