China property developers Index tumbles 2% pushing CSI300 to the lowest in2023

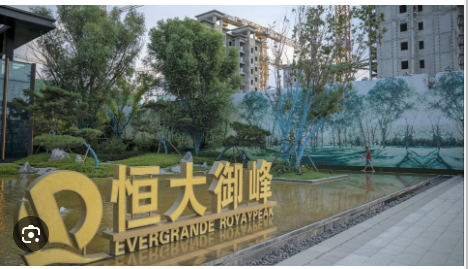

China property developers Index slumped more than 2% making the CSI300 Index fell to its lowest level this year before trading up 0.4% as embattled Evergrande Group shares plunged 25% on Monday after police detained some staff at its wealth management unit، suggesting a new investigation that could add to its woes and distressed Chinese Country Garden Holdings Co. faces two more tests today: an initial deadline to pay dollar bond interest and the end of creditor voting on its request to extend payment on a yuan note.

China property developers Index، a gauge of real estate shares، fell when the Chinese stocks listed in Hong Kong began the week with losses as persistent concerns about the health of the property sector offset optimism spurred by signs of stabilization in some other parts of the economy.

China property developers Index slid due to Evergrande Group woes

Bloomberg News Agency reported that China property developers Index dropped as the Hang Seng China Enterprises Index slid as much as 1.7% before paring some losses، while on the mainland، Chinese Stocks in Hong Kong drop as Property Woes Sour Sentiment because of the woes of Evergrande Group and distressed Country Garden Holdings Co.، the two biggest real estate companies in China.

China property developers Index shrank due to Evergrande، the world's most indebted property developer، is at the centre of a crisis in China's real estate sector that has seen a string of defaults since late 2021 that have rattled global markets and sparked fears of contagion that trading in the company's stock was suspended for 17 months until Aug. 28.

China property developers Index faces more losses since 2021

China property developers Index faces more losses during protests by disgruntled investors at Evergrande's Shenzhen headquarters in 2021، Du Liang was identified by staff as general manager and legal representative of Evergrande's wealth management division.

China property developers Index slid today after the police in the southern city of Shenzhen said in a social media statement on Saturday night that public security organs took criminal compulsory measures against Du and other suspected criminals at Evergrande Financial Wealth Management Co.but it is not confirmed that Du was among those detained، and the police statement did not specify the number of people detained، the charges or the date they were taken into custody.

China property developers Index plunged for Evergrande net loss

China property developers Index plunged also as the Chinese developer Evergrande Group posted a January-June net loss of 33 billion yuan ($4.5 billion)، versus a 66.4 billion yuan loss in the same period the previous year and the company delayed making a decision on offshore debt restructuring from September to next month to allow holders of its debt more time to consider its restructuring plan.

China property developers Index fell although recent economic data has been encouraging and Beijing has taken a series of market measures to revive investor confidence but foreign funds have sold onshore Chinese stocks on a net basis for six straight weeks، while their growing exodus from local assets is diminishing the market’s clout in global portfolios and accelerating its decoupling from the rest of the world.

The crux of the issue for the market at present is real estate

Yang Zhiyong، fund manager at Beijing Gemchart Asset Management Co.، affirmed that though the economic data showed some recovery، the crux of the issue for the market at present is real estate and China property developers Index، in spite of the raft of measures to prop-up sales، the recovery in prices and volumes seems limited to large cities.

China’s economic slump due to years of Covid restrictions، the crisis in its property market and persistent tensions with the West have weighed on its stock market and China property developers Index that the concerns have helped make the “avoid China” theme one of the biggest convictions among global fund managers in Bank of America’s latest survey.

Stoking optimism with continued losses of China property developers Index

Meanwhile، continued losses of China property developers Index are stoking optimism among some local investors that the bearishness has likely reached extreme levels as the MSCI China Index is down more than 7% in 2023، for the third straight year of losses that will mark the longest losing streak in over two decades.

Chinese stocks in Hong Kong plunge as property woes sour sentiment that some $188 Billion exodus shows China’s heft fading in World Markets، however ome investors in Beijing and Shanghai state that there is no need to be more bearish at the current levels، while other investors believe the Chinese authorities are keen to defend a floor for the stock/bond/currency markets.

-1120252475029447.jpg)