JLL: Egypt to double the private sector’s role in the economy to65%

JLL، the American leading professional services firm that specializes in real estate and investment management، stated in its report about Cairo Real Estate Market Overview for Q1 2023، that a rebooted privatisation program aimed at injecting much-needed foreign direct investments (FDIs) into the Egyptian economy is likely to spur construction activities in Egypt and accelerate the recovery of Cairo’s real estate sector in the coming years.

JLL، a Fortune 500 company with annual revenue of $20.9 billion، affirmed that with the ongoing divestment of state-owned assets in Egypt، the government aims to double the private sector’s role in the economy to 65% and attract USD 40 billion in private investment by 2026.

Ongoing privatisation program set to accelerate the overall growth of Egypt real estate market in the long run as residential market sees an average of 25% increase in sale prices across both 6th October and New Cairo، while Cairo’s existing hotel stock remained stable in Q1، set to grow with surge in tourist arrivals and more flexible office operators set to expand in Cairo، as well as retail rents of primary malls remained stable and secondary malls witnessedan average growth rate of 4%.

Egypt aims to double the private sector’s role in the economy

JLL، whose operations in over 80 countries and a global workforce of more than 103،000 as of December 31، 2022، revealed that this move to catalyse additional funding from regional and international investors to mitigate the ongoing macroeconomic challenges and stabilise foreign exchange rates in Egypt will pave the way for increased levels of occupier and investment activity in diverse real estate segments including residential، retail، hospitality، and commercial office spaces in the years ahead.

Ayman Sami، Country Head، at JLL Egypt، said that the anticipated FDI inflow is fuelling optimism and expected to relieve pressure on real estate activities across the country، particularly in Cairo، and the government’s proactive measures in the form of state support and extension of construction deadlines are aimed to ease the current challenges in the real estate sector، enabling stakeholders to navigate the economic headwinds.

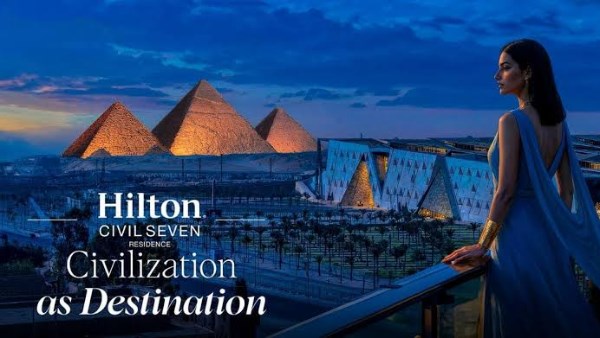

Positive outlook for the hospitality sector

JLL، the brand name، and a registered trademark، of Jones Lang LaSalle Incorporated، indicated that healthy tourist inflows، increased capital expenditure on infrastructure projects and tourism attractions، as well as the growing presence of global hospitality brands signal a positive outlook for the hospitality sector in Cairo.

JLL، the American leading professional services firm that specializes in real estate and investment management، added that Cairo’s existing hotel stock remained in Q1 2023، stable at 28 thousand keys and the city is expected to see the completion of around 900 keys during the year.

Hilton to double its project portfolio in Egypt

Hilton plans to nearly double its project portfolio in Egypt over the next three to five years demonstratinghow major operators view the country’s hospitality sector as an investment opportunity and this year، the hospitality giant will open two hotels، including the first "Waldorf Astoria" luxury brand in Cairo، Heliopolis، according to JLL's report about Cairo Real Estate Market Overview for Q1 2023.

JLL's report about Cairo Real Estate Market Overview explained that the weakening of the Egyptian pound has appealed to tourists and the country is expected to welcome 15 million visitors this year، a 28% increase from 2022 and the government’s concerted efforts to support tourism with enhanced connectivity and infrastructure، as well as the announcement of a 5-year visa for 180 nationalities، saw a 34% increase in tourist arrivals in the first two months of 2023 alone.

Cairo’s occupancy levels were registered at 74% in the YT February 2023 compared to 62% during the same period last year. While average daily rates (ADR’s) and revenue per available room (RevPAR’s) jumped by 19% and 40% respectively recording USD 135 and USD 100 over the same period، as JLL reported.

Continued growth in the residential rental market

JLL، the American leading professional services firm assured that around 4،000 residential units were delivered in Q1 2023، bringing the total existing stock to about 249 thousand units and expected that the remainder of the year will see the completion of over 29 thousand units.

However، delays in project completions are expected due to hikes in construction costs، which، in turn،would hinder developers’ timelines. Moreover، some developers have decided to halt their announced developments، while new project launches remained roughly muted in Q1، JLL foresaw.

Strong growth in the rental market

JLL، the American leading professional services firm that specializes in real estate and investment management، asserted that the rental market witnessed strong growth، with rents increasing annually at a faster pace (than in previous quarters) of 11% in 6th October and 8% in New Cairo.

It anticipated that the responsive measures by the government to buoy the housing market and the fundamentally strong local demand is likely to escalate the sector in the coming years as Emaar Misr has، in a bold move، become the first developer in Cairo to start selling units of one of its projects at the current price of the USD exchange rate with a cap on exchange to hedge against the rising construction costs and safeguard the continuity of its projects.

Across the Middle East and Africa (MEA)، JLL is a leading player in the real estate and hospitality services markets and has worked in 35 countries across the region and employs over 1450 internationally qualified professionals across its offices in Dubai، Abu Dhabi، Riyadh، Jeddah، Al Khobar، Cairo، Casablanca، Johannesburg، and Nairobi. For further information، visitjll-mena.com.

Surge in demand for flexible offices

The total office stock in Cairo currently stands at around 1.9 million sq. m. following the delivery of almost 21،000 sq. m. of office gross leasable area (GLA) in the first quarter of 2023. JLL estimates that another 310،000 sq. m. of office floorspace will be completed by year-end، JLL emphasized.

In the last quarter، average city-wide rents were reduced by 1% on annual basis and recorded at USD 358 per sq. m. per annum. However، in reality، rents were high when converted to the local currency on the back of the continued depreciation of the Egyptian pound، according to its report.

Activity from multinationals and new market entrants remained weak in Q1، with call centers continuing to drive the majority of demand for smaller grade B office units. Consequently، the market-wide vacancy rate jumped to 13% in the first quarter of 2023.

The current inflated rents and volatile currency situation also saw more tenants resort to signing short-term flexible leases of fitted office units، encouraging more flexible office operatorsto expand in the capital.

Retail to rebound in the long-term

The force of Egypt’s sizable and growing population as well as its culture that embraces shopping and outings is expected to accelerate the retail sector in the long run. In Cairo، Q1 2023 saw the completion of almost 19،000 sq. m. of retail spacebringing the total inventory to about 2.9 million sq. m.

The period was also marked by the suspension or postponement of completion dates of several projects on the back of rising construction costs and the challenges in leasing، stemming from the market's high concentration of malls within a small catchment.

Demand and footfall in regional and super-regional malls remained low last quarter، whereas strip retail and community centers performed slightly better thanks to their relative accessibility and the strong performance of the F&B segment.

Average rental rates of primary malls in the first quarter of 2023 remained stable on a yearly basis while the secondary retail malls witnessed an average growth rate of 4%. Over the same period، the average vacancy rate reduced slightly to 9% from 11% in Q1 2022.

To generate short-term revenues and maintain control over their tenant mix، some landlords have opted to sell less than 50% ownership of retail units to potential investors. By the end of 2023، the sector will see the completion of about 195 thousand sq. m. of retail GLA.

-1120252475029447.jpg)