The oil market was trading lower on Monday

Middle East ocean freight rates soar on Iran conflict, Strait of Hormuz shipping risks

Ocean freight rates from Shanghai to the Port of Khor Fakkan on the United Arab Emirates’ Indian Ocean coastline are up 76% compared to mid-May, reaching $3,341 per forty-foot equivalent unit.

The spread between long-term rates and spot rates has surged from $50 to $1,100, according to Xeneta.

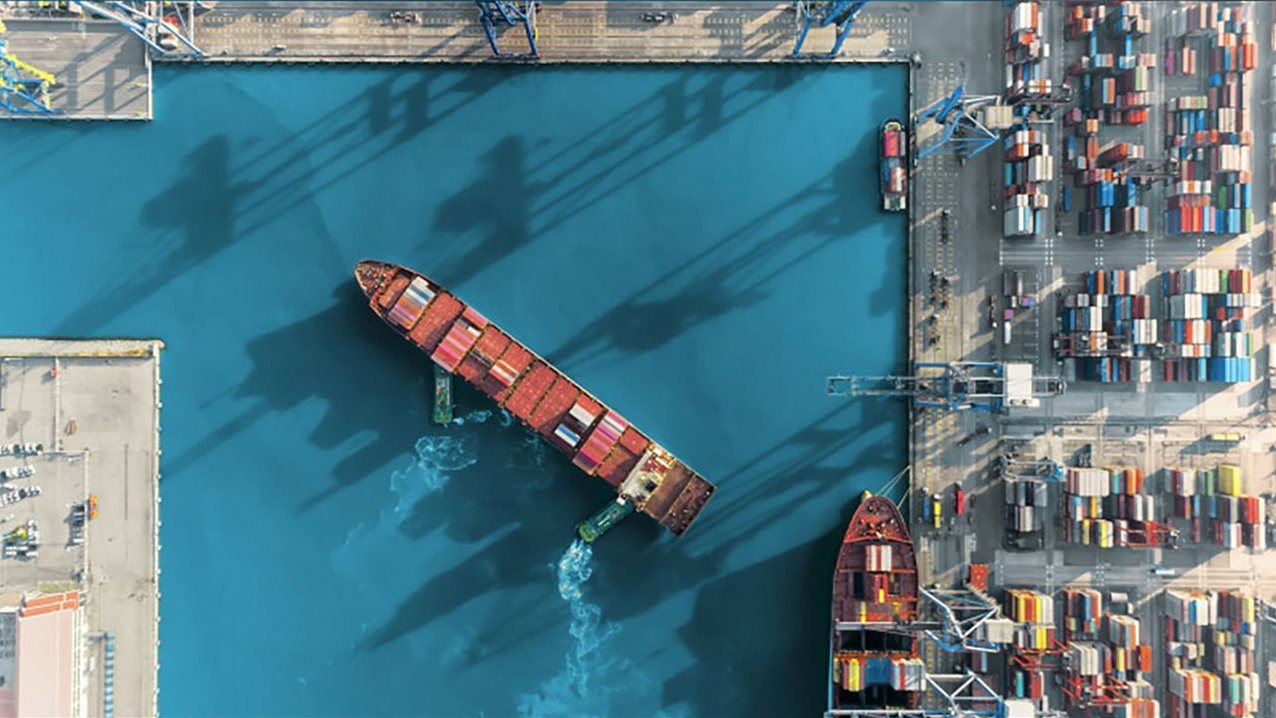

Tankers are seen at the Khor Fakkan Container Terminal, the only natural deep-sea port in the region and one of the major container ports in the Sharjah Emirate, along the Strait of Hormuz, a waterway through which one-fifth of global oil output passes on June 23, 2025.

Tankers are seen at the Khor Fakkan Container Terminal, the only natural deep-sea port in the region and one of the major container ports in the Sharjah Emirate, along the Strait of Hormuz, a waterway through which one-fifth of global oil output passes on June 23, 2025.

Ocean freight rates to the Port of Khor Fakkan in the United Arab Emirates are surging as Israel continues to attack Iran and Iran reported its first attack on a U.S. military base, in Qatar, after a weekend which saw U.S. strikes on Iranian nuclear targets.

Rates from Shanghai to the Khor Fakkan, which is situated on the UAE Indian Ocean coastline, are up 76% in comparison to mid-May, according to spot ocean freight rate data tracked by freight intelligence platform Xeneta. The average spot rates have reached $3,341 per forty-foot equivalent unit (FEU.)

The Port of Khor Fakkan is located outside the Strait of Hormuz. Due to its location, the port is considered to be one of the most important transshipment hubs for the Arabian Gulf, the Indian Sub-continent, the Gulf of Oman, and the East African markets.

“Shippers in the region have acted with caution as the level of risk has gradually increased,” said Peter Sand, chief shipping analyst at Xeneta. “Shippers have been frontloading cargo in the most recent months, to bolster the supply chain from adverse disruptions to the flow of containerized goods.”

The Port of Khor Fakkan has had 81 vessels arrive within the past 24 hours, and 51 ships are expected to arrive in the next 30 days, according to VesselFinder.

Elevating vessel security risks

The conflict in the Middle East has elevated vessel security risks, which have added to operational costs. Vessels are also moving faster, which results in more fuel being used, which also adds to costs.

Iran’s parliament voted to approve a closure of the Strait of Hormuz on Sunday, but it may not follow through on the move, according to many experts. It is expected to target ships for attack or seizure as part of its retaliatory plans, including ships showing a public U.S. affiliation, according to maritime security firm Ambrey.

One major oil tanker operator, Frontline, recently said it would accept no new contracts requiring travel in the Strait of Hormuz.

The oil market was trading lower on Monday and the stock market reaction to the escalation in the conflict was muted. Sand said the spread in ocean freight rates is a leading indicator of risk and uncertainty. The spread refers to the difference between spot market rates and long-term contract rates. The higher the spread, the greater the indication of market volatility and potential risks for shippers.

“During times like this, the spread in the market widens,” said Sand.

It is up from $50 to $1,101 over the past 40 days (May 14 to June 23), according to Xeneta.

“The spread is showing the difference between what the smaller shippers, those without much negotiation power, versus the freight rates paid by the larger and stronger shippers,” he added.

-1120252475029447.jpg)