Spot gold was down 2.6% at $4,005.11 per ounce

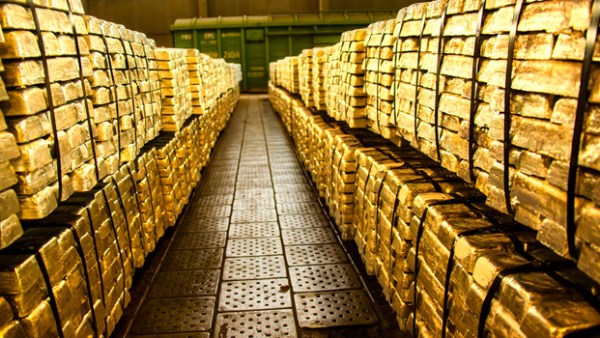

Gold slips below $4,000 per ounce as US-China trade progress cools safe-haven demand

Gold prices fell below $4,000 per ounce on Monday as signs of a thaw in U.S-China trade tensions reduced some of bullion's safe-haven appeal, while market participants awaited the Federal Reserve's interest rate decision this week.

Spot gold was down 2.6% at $4,005.11 per ounce at 10:13 a.m. ET (1413 GMT), after briefly falling below the $4,000 per ounce mark earlier in the session. U.S. gold futures for December delivery were down 2.9% at $4,019.00.

In addition to technical selling, gold is "seeing a further decline because of an unwinding of trade tensions that had taken prices from $3,800 to $4,400 over the course of the first three weeks of October," said CPM Group managing partner Jeffrey Christian.

Gold, a traditional safe haven, climbed to a record high of $4,381.21/oz on October 20, but retreated 3.2% last week following hints of easing trade tensions between the world's two largest economies. Negotiators from the U.S. and China on Sunday outlined the framework for a deal to pause steeper American tariffs and Chinese rare earths export controls.

U.S. President Donald Trump and China's Xi Jinping are expected to meet on Thursday to further discuss a trade accord.

Meanwhile, the market sees a 97% chance of a quarter basis point reduction at the Fed' meeting on Wednesday.

Gold, being a non-yielding asset, typically performs well in a low-interest rate environment.

While most analysts and investors see further highs for the yellow metal, even bringing $5,000/oz into view, some are sceptical about the sustainability of its recent huge rise.

Capital Economics analysts on Monday lowered their gold price forecast to $3,500/oz for end-2026.

Spot silver fell 3.8% to $46.75 per ounce, platinum eased 1.1% to $1,588.86, and palladium 1.3% to $1,409.47.

-1120252475029447.jpg)